Merak Planning

To be competitive in today's rapidly changing business environment, companies must make the right decisions to increase value and stakeholders’ returns. Organizations that can respond swiftly to sudden changes in a turbulent market, and make effective use of their capital to take advantage of available opportunities, will be successful in optimizing corporate performance.

Merak Enterprise Planning Dynamic and event-driven enterprise planning

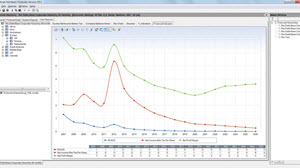

Merak Enterprise Planning is a business planning platform that generates high-value planning and performance tracking information from a fast and efficient calculation engine. It enables oil and gas organizations to shift from static and lengthy annual planning to more dynamic, event-driven, and evergreen planning. Merak Enterprise Planning allows the alignment of economics, reserves, production, financials, human resources, asset operations, and actuals on a common planning framework. Merak Enterprise Planning delivers results to analysts and senior management on demand and in the right context, gathering inputs, analyses, and results in a single system that provides role-based views to ensure secure visualization of planning information across the enterprise.

Merak Capital Planning Achieve desired portfolio value and attain corporate goals in the short and long term

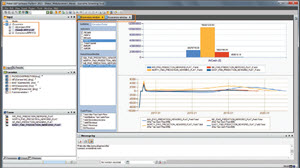

Merak Capital Planning is a specialized portfolio management software proven to optimize an oil and gas company’s portfolio of investments, regardless of scale, by modeling changes in technical and business constraints within today’s fluid operations environment. This approach to business planning continually aligns investment choices with corporate goals while adhering to operational and real-world business constraints. Capital Planning uses Monte Carlo stochastic analysis and world-class optimization techniques to deliver an optimal combination of investment options—a portfolio that assures a high level of confidence in delivering those goals, while at the same time efficiently balancing value and risk. Whether for an independent, a major, or a national oil company, Merak Capital Planning provides the assurance that each investment decision is aligned with that company’s corporate strategy.

Capabilities Streamline your business planning process

- Spend more time analyzing additional portfolio and investment options and less time collecting and validating data. Some supported data types are Excel, flat files, ERP systems, Schlumberger Applications (Merak planning, risk, and reserves software, Avocet production operations software platform and OFM well and reservoir analysis software), MS Access and others.

- Evaluate more portfolio alternatives to better understand how each option achieves your strategic goals and KPIs

- Analyze different portfolios to select those with the best balance of relative risk and potential return &a